The Power Dynamic in Bollywood: A Closed Circle

For years, the money and power to produce A-list films in Bollywood has been held by few production companies. These companies hold considerable influence over the direction of the film industry, often deciding which actors are “worthy” of starring in big-budget films. These actors, the “top 10” stars, hold enormous sway in determining what gets made and what doesn’t, perpetuating a cycle where only certain actors are continually seen as bankable by producers.

The leading actors and production houses dictate the films that are greenlit. This approach has long shaped Bollywood’s landscape. However, this model was severely tested in the post-pandemic world, particularly during 2021 and 2022, when the box office was left reeling from a sharp decline in footfall.

Post-Covid Box-Office Crisis: The Industry on Ventilator

In 2022 when theaters reopened in a regular way following the Covid-19 pandemic, the box office was in a dire state. The lack of content, coupled with the reluctance of audiences to return to cinemas, left theaters struggling. Major films that were expected to pull in audiences underperformed, and for a while, it seemed like the industry was in freefall. Theaters, reliant on big-budget blockbusters, found themselves with little to no content to keep audiences from returning.

By mid 2022, though the industry had big hits like Drishyam 2, The Kerala Story, Bhool Bhulaiyaa 2, Gangubai Kathiwadi and Brahmastra: Part 1-Shiva, but industry cannot survive on a bunch of successful films and thus the crisis deepened. Even producers with significant power in the industry had no idea what would work at the box office. The uncertainty led to hesitation in greenlighting new theatrical films.

Trade Expert Komal Nahata says , “ There is a lot of uncertainty and that is why people in the industry are contemplating and deciding what to do …they don’t have a ready made answer of what is working and what is not working so they have taken two steps back and would rather wait than just rush. Producers are wondering what is for OTT , what is for the big screen and thus the speed of production has reduced.”

In the interim, many producers had shifted focus to streaming platforms, believing that the direct-to-OTT model offered more stability. The strategy seemed logical at the time—OTT platforms were still booming, with audiences enjoying the convenience of consuming content at home. The industry pivoted towards making commissioned series and direct-to-digital releases, while theatrical releases took a backseat.

OTT Saturation and the Box-Office Revival

While the OTT boom provided a temporary solution, it soon reached a tipping point. Streaming platforms spent vast amounts of money on acquiring and producing content during 2021-2022. However, the rush to release new content led to a saturation of poor-quality films and series. Audiences began to feel the fatigue, as much of the content failed to connect.The very platforms that were once seen as the future of entertainment found themselves flooded with mediocre offerings, with only a few standout hits managing to grab attention.

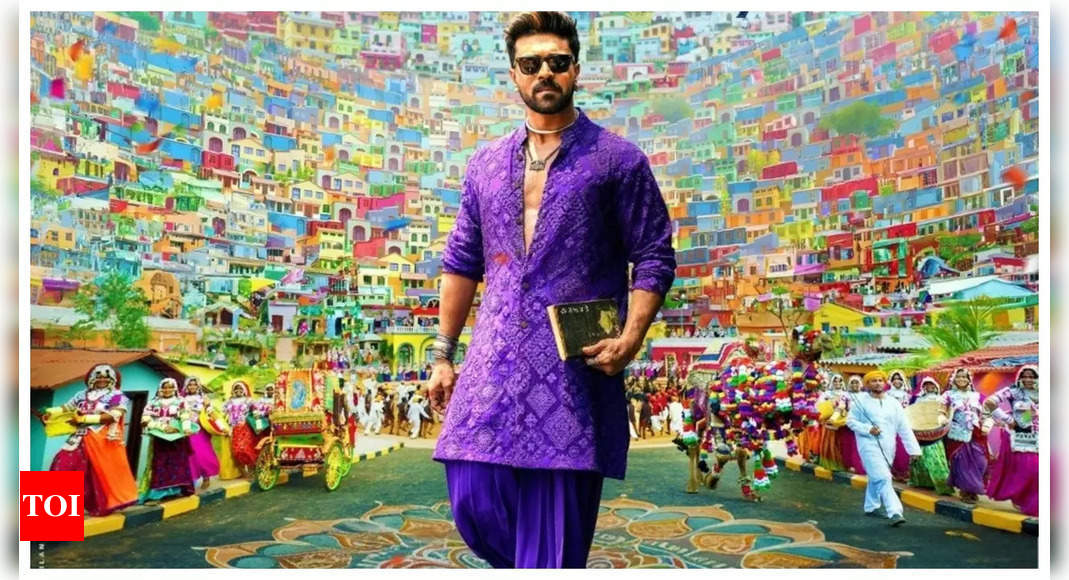

Meanwhile, 2023 witnessed an unexpected revival of the box office. A series of big hits, both in Bollywood and regional cinema, breathed new life into the theaters. Films like Animal, OMG 2, Pathaan, Gadar 2, Jawan, The Kerala Story, Tiger 3, and Rocky Aur Rani Kii Prem Kahaani brought back the magic of theatrical experiences, with audiences flocking to cinemas for the larger-than-life spectacle they couldn’t replicate at home.

This revival proved that the appetite for big-screen entertainment was far from dead. However, OTT platforms, having already spent much of their budgets on underperforming content, began to scale back their spending. With fewer resources, many platforms cut down their investments in direct-to-OTT films. This, in turn, led to a decline in the number of films being made for both OTT and theaters.

While discussing the topic of OTT and film releases veteran director David Dhawan during his conversation with Arbaaz Khan said. “I tell this to every actor. Why do you want to play so safe with OTT where you don’t even know how much a project has worked? Theatre mein aao, apni aukaat dikhao tum. (Come to the theatre and show your worth),”

The Shrinking Slate of Theatrical Releases

The effect of OTT’s spending cuts and the reluctance of major production houses to invest in theatrical releases has led to a peculiar situation in 2023-2024. The number of new, significant theatrical releases has dropped dramatically, creating a void in the cinema calendar.

For months at a time, theaters are left without any major new films to show, forcing them to rely on re-releases and older films to keep their doors open.This gap is particularly evident as we approach October 2024. Post Stree 2 which released on 15th August, there is no big release till 11th October which will again see two films Alai Bhatt’s Jigra and Rajkummar Rao’s Vicky Vidya Ka Woh Wala Video clashing.

The audience, still hungry for fresh, engaging content, is being starved of new films, and theaters are relying on older blockbusters or regional cinema to sustain themselves. This drought of new releases is expected to continue until mid-October, when the next wave of films is slated to arrive.

Trade Analyst Taran Adarsh agrees to the fact that number of films have gone down, he says , “ The numbers of films being made have gone down and there are multiple reasons for that . To start with the actors have become producers themselves and even the traditional producers are finding it difficult to get those actors on board and with the economics of films going haywire no one is interested in announcing a project for the heck of it , they feel it is better to wait and watch. Take Maddock for example, they have given three back to back hits in Zara Hatke Zara Bachke, Munjya and Stree 2 , which only goes to show that you only need content, even if the film doesn’t have a star. Like who was the star in Munjya ? Of course stars are important and not taking away anything from them but you need to get the content right.”

Fixing the Industry: Chasing Scripts, Not Stars

The current state of the industry can be traced back to a fundamental problem: the over-reliance on a small pool of actors and the power they wield over the production process. As long as major production companies continue to chase the same 10 star-actors with “greenlighting power,” the industry will remain stuck in a cycle that limits creativity and innovation.

The solution lies in a shift in priorities. Instead of focusing solely on big names, producers need to start chasing good scripts and packaging them with talented actors—both established and emerging. Komal Nahata agrees to the point and says , “ Producers are not willing to attempt something new and newness is what clicks but they are scared.”

By broadening the pool of talent and giving opportunities to new actors, the industry can create a more diverse and dynamic range of films. Investing in fresh faces and original stories will not only break the stranglehold of a few actors, but will also help revive the industry’s creative energy.

Moreover, there is an urgent need for producers with money and power to recognize the long-term potential of building new stars, rather than relying on the same handful of actors. Much like the success of small-budget, content-driven films in recent years, this approach can lead to unexpected box office successes, while simultaneously revitalizing the industry with new voices and ideas.

Conclusion: A Critical Turning Point for Bollywood

The Indian film industry is at a critical turning point. With OTT platforms scaling back their investments and theaters struggling to find fresh content, the industry must re-evaluate its priorities. The reliance on star power and a handful of production companies hoarding resources has stifled creativity and left cinemas in a precarious position.

If the industry is to thrive in the future, it must break free from this narrow focus on star-driven projects and invest in diverse, high-quality content. The revival of the box office in 2023 proves that audiences are willing to return to theaters, but they need films that excite and engage them. By chasing scripts and nurturing new talent, Bollywood can once again become a powerhouse of creativity, providing audiences with the cinematic experiences they crave.

function loadSurvicateJs(allowedSurvicateSections = []){ const section = window.location.pathname.split('/')[1] const isHomePageAllowed = window.location.pathname === '/' && allowedSurvicateSections.includes('homepage')

if(allowedSurvicateSections.includes(section) || isHomePageAllowed){ (function(w) {

function setAttributes() { var prime_user_status = window.isPrime ? 'paid' : 'free' ; w._sva.setVisitorTraits({ toi_user_subscription_status : prime_user_status }); }

if (w._sva && w._sva.setVisitorTraits) { setAttributes(); } else { w.addEventListener("SurvicateReady", setAttributes); }

var s = document.createElement('script'); s.src="https://survey.survicate.com/workspaces/0be6ae9845d14a7c8ff08a7a00bd9b21/web_surveys.js"; s.async = true; var e = document.getElementsByTagName('script')[0]; e.parentNode.insertBefore(s, e); })(window); }

}

window.TimesApps = window.TimesApps || {};

var TimesApps = window.TimesApps;

TimesApps.toiPlusEvents = function(config) {

var isConfigAvailable = "toiplus_site_settings" in f && "isFBCampaignActive" in f.toiplus_site_settings && "isGoogleCampaignActive" in f.toiplus_site_settings;

var isPrimeUser = window.isPrime;

var isPrimeUserLayout = window.isPrimeUserLayout;

if (isConfigAvailable && !isPrimeUser) {

loadGtagEvents(f.toiplus_site_settings.isGoogleCampaignActive);

loadFBEvents(f.toiplus_site_settings.isFBCampaignActive);

loadSurvicateJs(f.toiplus_site_settings.allowedSurvicateSections);

} else {

var JarvisUrl="https://jarvis.indiatimes.com/v1/feeds/toi_plus/site_settings/643526e21443833f0c454615?db_env=published";

window.getFromClient(JarvisUrl, function(config){

if (config) {

const allowedSectionSuricate = (isPrimeUserLayout) ? config?.allowedSurvicatePrimeSections : config?.allowedSurvicateSections

loadGtagEvents(config?.isGoogleCampaignActive);

loadFBEvents(config?.isFBCampaignActive);

loadSurvicateJs(allowedSectionSuricate);

}

})

}

};

})(

window,

document,

'script',

);

Source link

![Pushpa 2 Full Movie Collection: Pushpa 2 box office collection day 14 [updated live]: Allu Arjun and Rashmika Mandanna’s collects 975 cr by 2nd Thursday morning; to join elusive 1000 crore club soon | – Times of India](https://static.toiimg.com/thumb/msid-116464525,width-1070,height-580,imgsize-70816,resizemode-75,overlay-toi_sw,pt-32,y_pad-40/photo.jpg)